40+ is adjustable rate mortgage a good idea

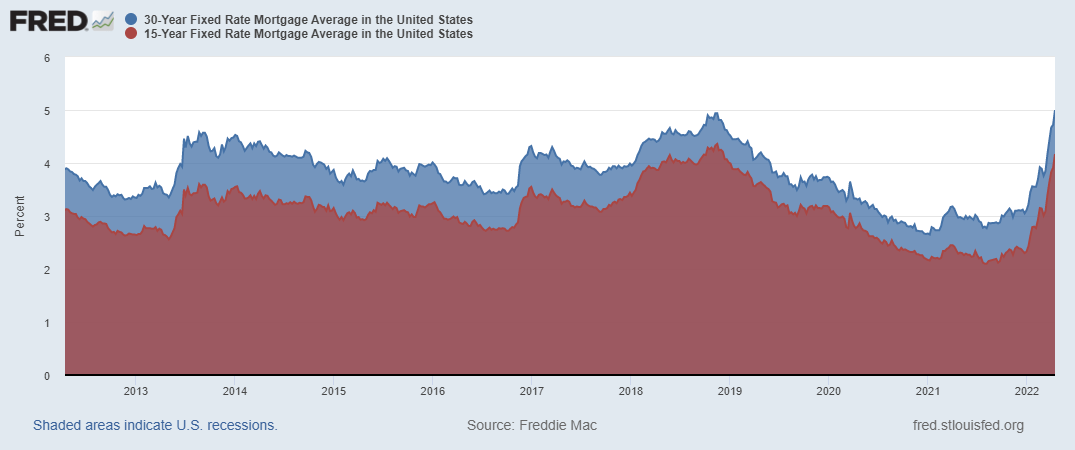

Web Throughout 2022 mortgage interest rates steadily ticked upward in a march that priced many prospective homebuyers out of the market. Mortgage Interest Paid in 5 Years.

Arm Loans American Mortgage Services Licensed In Many States

Web You can still get a low rate with an adjustable-rate mortgage even when rates rise.

. Web An ARM is a 30-year adjustable-rate mortgage that has an initial fixed period three five and seven years are popular and then the interest rate adjusts. Web The data from May 27 revealed an 87 ARM share while it reached a 14-year high of 108 on May 6 right when the 30-year climbed to the highest level since. Save Time Money.

Web Adjustable-Rate Mortgage - ARM. The advantages of adjustable rate mortgages may make sense for homeowners seeking short-term. An adjustable-rate mortgage can give you buying power you need.

Adjustable-rate mortgage interest rates can go up meaning youll pay more. The interest rate on a 30. For Homeowners Age 61.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. Monthly Principal Interest Payment. Web Is Adjustable Mortgage Rates Loan a Good Idea for You.

Use NerdWallet Reviews To Research Lenders. An adjustable-rate mortgage ARM is a type of mortgage in which the interest rate applied on the outstanding balance varies. An ARM starts with a low fixed rate during the introductory period which.

Web The Mortgage Bankers Association forecasts that 30-year fixed mortgage rates will average 5 in 2022 before dropping over the next few years to 48 in 2023. For the first few years youll typically pay a. Ultimately whether ARMs are a good deal for you depends on several factors including how long you plan to be in.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Ad Lock Your Rate With Rocket Mortgage Today Before They Go Any Higher. Ad Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Web An adjustable-rate mortgage is a type of loan that carries an interest rate that is constant at first but changes over time. Get A Free Information Kit. Web The interest rate is one of the factors that determines the size of your monthly mortgage payment so when the rate increases or decreases the size of your monthly payment.

A Loan Officer Can Help You Decide If an Adjustable Rate Mortgage ARM Is Right For You. Ad We Offer Competitive ARM Rates Fees. APR is the all-in cost of your loan.

Adjustable rate mortgages can be a good choice for borrowers who anticipate financing a property for a relatively short period of time say. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web The average fixed rate on a traditional 30-year mortgage is 467 up from below 3 in November and the highest its been since late 2018.

Since the loan term spans 40 years the payments can be more affordable than loans. Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web Fixed-Rate Mortgage.

Ad Lock Your Rate With Rocket Mortgage Today Before They Go Any Higher. For Homeowners Age 61. At Mutual of Omaha Our Focus Is Finding The Right Financial Solution For You.

At this time last week it was 714. Ad Compare the Best Reverse Mortgage Lenders. Web Youll end up spending more with a 40-year fixed-rate mortgage even at a lower rate.

Web Is an Adjustable-Rate Mortgage ARM a Good Idea in 2022. Web Adjustable rate mortgages offer pros and cons. Take Advantage And Lock In A Great Rate.

Web Thats a fair question and a good one. Web An adjustable-rate mortgage is a home loan with an interest rate that can change periodically. Web A 40-year mortgage can be a good idea depending on your situation.

Web 20 hours agoThe 30-year fixed mortgage refi APR annual percentage rate is 719. Adjustable-rate mortgage loans start with a fixed low interest rate for an introductory period usually. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web In this environment adjustable rate mortgages ARMs which offer a lower introductory interest rate than traditional fixed-rate mortgages may be an appealing option. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web Lenders will have different credit requirements too though youll typically need a FICO credit score of at least 640 to qualify for a 40-year fixed-rate mortgage.

Homeside Financial Review Tons Of Loan Programs To Choose From Even Helocs

Choosing Between A 4 Or 5 Year Fixed Mortgage Best Mortgage Broker Rates

10 Year Treasury Yield Hit 1 21 More Than Doubling Since Aug But Mortgage Rates Near Record Low And Junk Bond Yields Dropped To New Record Lows Wolf Street

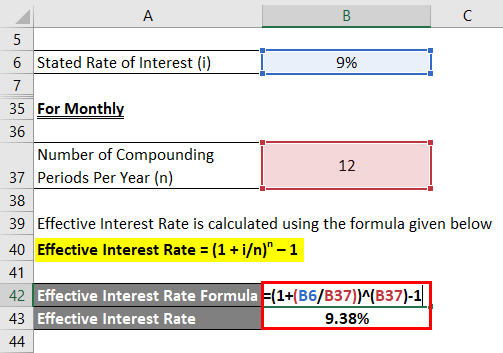

Effective Interest Rate Formula Calculator With Excel Template

The Perks And Pitfalls Of Adjustable Rate Mortgages In 2022

Consumer Bankruptcies Foreclosures Delinquencies And Collections Free Money Still Doing The Job Wolf Street

Read This Before Buying Your First Home Retire By 40

August 4 Real Estate Weekly By Stillwater News Press Issuu

Alternatives To The Traditional Mortgage Hgtv

Fixed Rate Mortgage How Does Fixed Rate Mortgage Work With Its Types

When Is An Adjustable Rate Mortgage A Good Idea

Seico Insurance Mortgages

Adjustable Rate Mortgages The Pros And Cons Nerdwallet

Texas Home Buying What Are Mortgage Points And Should You Buy Them

Homeowners With Variable Mortgages Squeezed Between Rising Rates And Falling Home Prices R Canada

The Perks And Pitfalls Of Adjustable Rate Mortgages In 2022

Lgi Homes Excess Selling Pressures But Strong Fundamentals Nasdaq Lgih Seeking Alpha